south san francisco sales tax 2019

In San Francisco the tax rate will rise from 85 to 8625. The current total local sales tax rate in San Francisco CA is 8625.

South San Francisco Store Svdp San Mateo

The December 2020 total local sales tax rate was 8500.

. The Sales and Use tax is rising across California including in San Francisco County. This is the total of state county and city sales tax rates. South San Francisco 5 Sales Tax.

Look up the current sales and use tax rate by address. Among major cities Chicago Illinois and Long Beach and Glendale California impose the highest combined state and local sales tax rates at 1025 percent. Persons other than lessors of residential real estate are required to file a return if in the tax year you were engaged in business in San Francisco were not otherwise exempt and you h ad more than 2000000in combined taxable San Francisco gross receipts.

An alternative sales tax rate of 9875 applies in the tax region Daly City which appertains to zip code 94080. While many other states allow counties and other. Interactive Tax Map Unlimited Use.

Exemption provisions are listed in Section 954The most common exemption is for certain non-profit organizations. South San Francisco in California has a tax rate of 925 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in South San Francisco totaling 175. Two of these resulted from recent voter-enacted initiatives notably.

The minimum combined 2022 sales tax rate for South San Francisco California is. With local taxes the total sales tax rate is between 7250 and 10500. ELECTION 2014 - June 3 San Benito County ballot measures.

The minimum combined 2022 sales tax rate for San Francisco County California is 863. The state sales tax rate in California is 7250. 1788 rows For a list of your current and historical rates go to the California City County Sales Use Tax Rates webpage.

South san francisco lies north of san bruno and san francisco. Most of these tax changes. November 2018 Elections - Santa Clara.

The south san francisco california general sales tax rate is 6. South San Francisco CA January 7 2019. The South San Francisco California sales tax rate of 9875 applies to the following two zip codes.

Property taxes are collected by the County Tax Collector for the City and various other taxes are collected by the State and. The minimum combined sales tax rate for San Francisco California is 85. The California state sales tax rate is currently 6.

The December 2020 total local sales tax rate was 9750. Argument Against South San Francisco Sales Tax Measure W. What is the sales tax rate in South San Francisco California.

How much is sales tax in San Francisco. Ad Lookup Sales Tax Rates For Free. The local sales tax rate in San Francisco California is 8625 as of June 2022.

750 Is this data incorrect The South San Francisco California sales tax is 750 the same as the California state sales tax. California City and County Sales and Use Tax Rates Rates Effective 10012018 through 03312019 City Rate County Acampo 7750 San Joaquin Acton 9500 Los Angeles. The Homelessness Gross Receipts Tax which was passed on November 6 2018 ballot is imposed on the gross receipts of a business above 50000000.

The current total local sales tax rate in South San Francisco CA is 9875. There are approximately 54126 people living in the South San Francisco area. Measure W authorized the.

A sales tax measure was on the ballot for South San Francisco voters in San Mateo County California on November 3 2015. California CA Sales Tax Rates by City. The following rates apply to the SOUTH SAN FRANCISCO tax region see note above Month.

The South San Francisco California sales tax is 925 consisting of 600 California state sales tax and 325 South San Francisco local sales taxesThe local sales tax consists of a 025. When the South San Francisco City Council requests voters grant them a sales tax hike like Measure W what are they. This is the total of state and county sales tax rates.

Persons other than lessors of residential real estate must file applicable Annual Business Tax Returns if they were engaged in business in San Francisco in 2019 as defined in Code section. This is the total of state county and city sales. The phone number for general tax questions is 1-800-400-7115.

Beginning January 1 2019 a number of tax law changes will become effective in the City of San Francisco the city. It was approved.

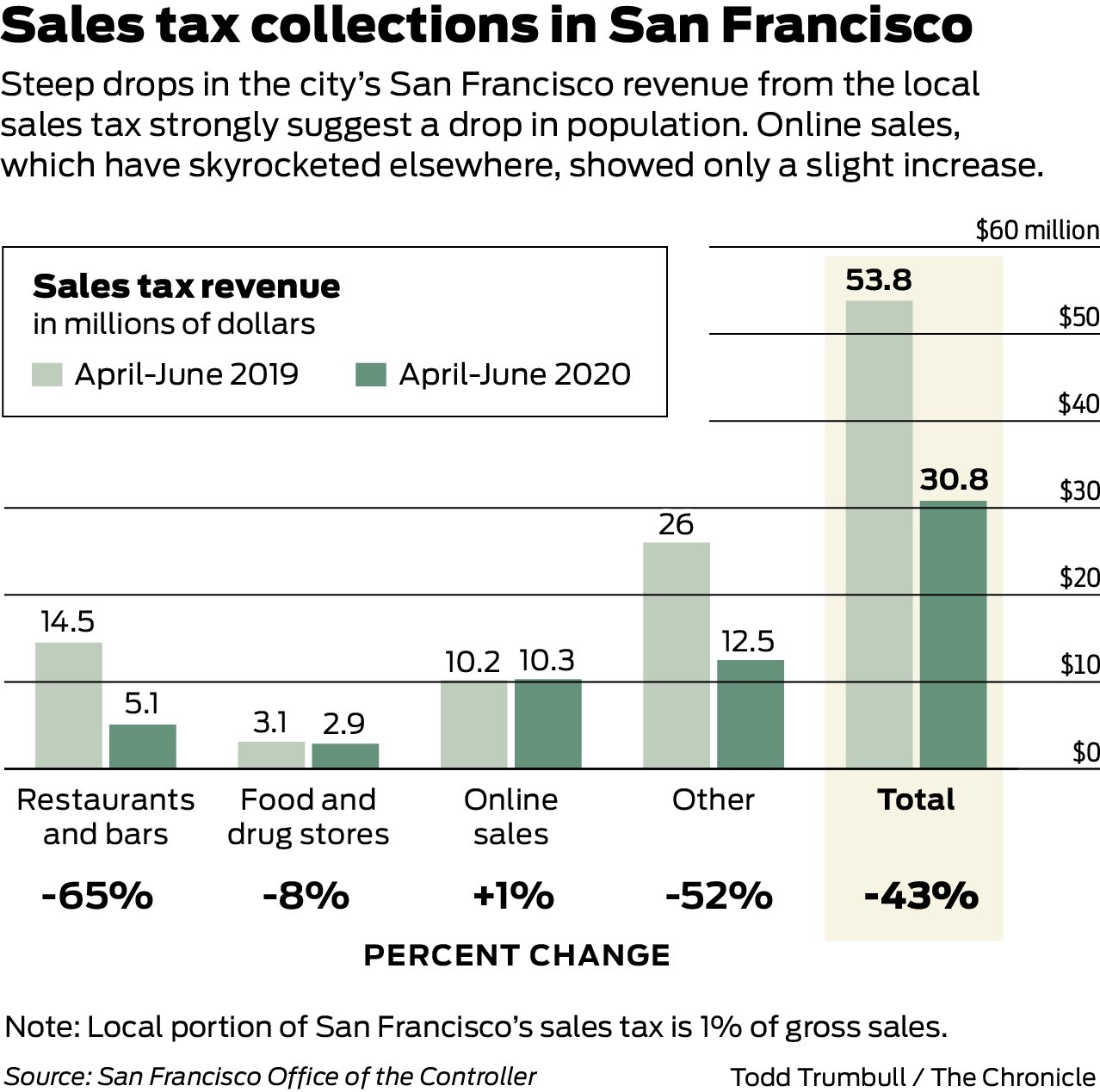

Yes People Are Leaving San Francisco After Decades Of Growth Is The City On The Decline

Finance Department City Of South San Francisco

Parks Recreation City Of South San Francisco

Parks Recreation City Of South San Francisco

Parks Recreation City Of South San Francisco

2306 Julie Ln South San Francisco Ca 94080 Mls 422619967 Zillow

171 Beaver St San Francisco Ca 94114 3 Beds 3 Baths San Francisco Two Level Deck

South San Francisco Store Svdp San Mateo

2419 17th Ave San Francisco Ca 94116 Mls 422664944 Redfin

With Price Reduced Homes For Sale In San Francisco Ca Realtor Com

Safest Neighborhoods In San Francisco What Are The Safest Areas In San Francisco To Live

Finance Department City Of South San Francisco

Homes In Downtown Fort Lauderdale Downtown Fort Lauderdale Fort Lauderdale Fort Lauderdale Beach

Finance Department City Of South San Francisco

Seattle S Tech Scene Looks Like San Francisco S Did 10 Years Ago What Gives Sf Citi

465 Dolores Way South San Francisco Ca 94080 Mls Ml81892347 Zillow